Start here

Moneysmart, by the Australian Government, helps you make confident money decisions with free tools, tips and calculators.

How to switch home loans

The Reserve Bank has lifted the cash rate this month by 25 basis points. Now could be a great time to compare your home loan options.

Calculate your savings

Learn about lead generation

Are you on a lead generation list? Learn what that means and what to look out for, before you make investment decisions.

Learn more

Starting to think about retirement?

Information, calculators and case studies to help you put together a plan that works for you.

Get ready

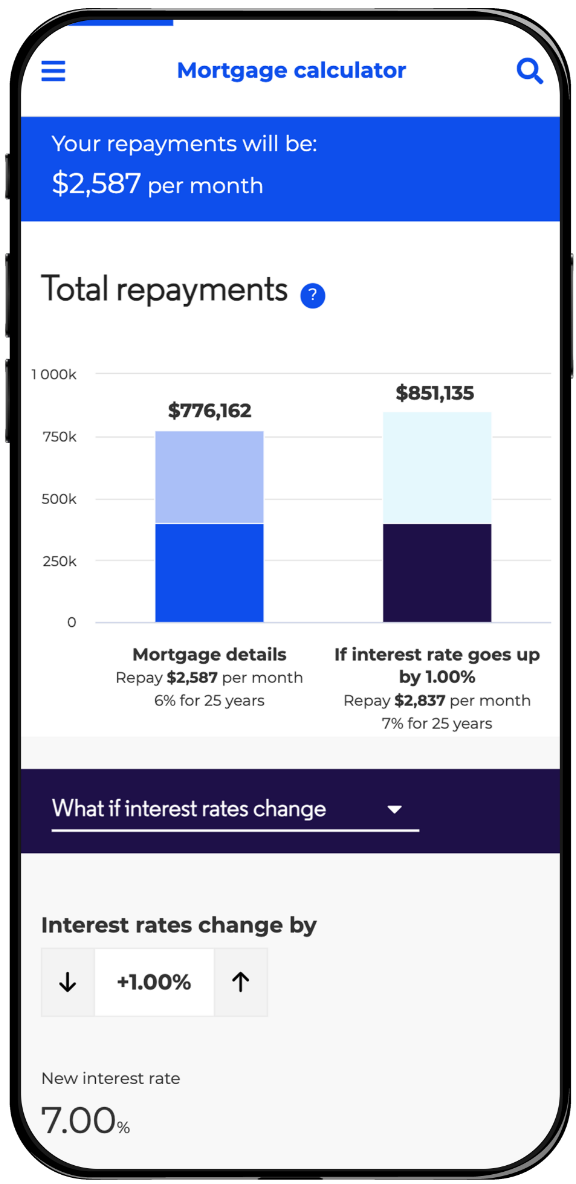

Calculators

Moneysmart's calculators help you set realistic goals and gives you the confidence to take the next step.

Budget planner

Work out where your money is going

Savings goals calculator

Set and reach your goals

Retirement planner

Find out your income when you retire

Income tax calculator

How much Australian income tax should you be paying?

Superannuation calculator

Find out your super balance at retirement

Get help with your money straight to your inbox.

- Sign up to Moneysmart Tips.

- Sign up