Start here

Moneysmart, by the Australian Government, helps you make confident money decisions with free tools, tips and calculators.

What to do after a natural disaster

How to manage after a bushfire, storm or flood.

Start here

Your Jan 26 'to do' list

Getting on top of your finances is one of the most common new year's resolutions. Here's 5 things to tick off your list.

Make it easy

Starting to think about retirement?

Information, calculators and case studies to help you put together a plan that works for you.

Get ready

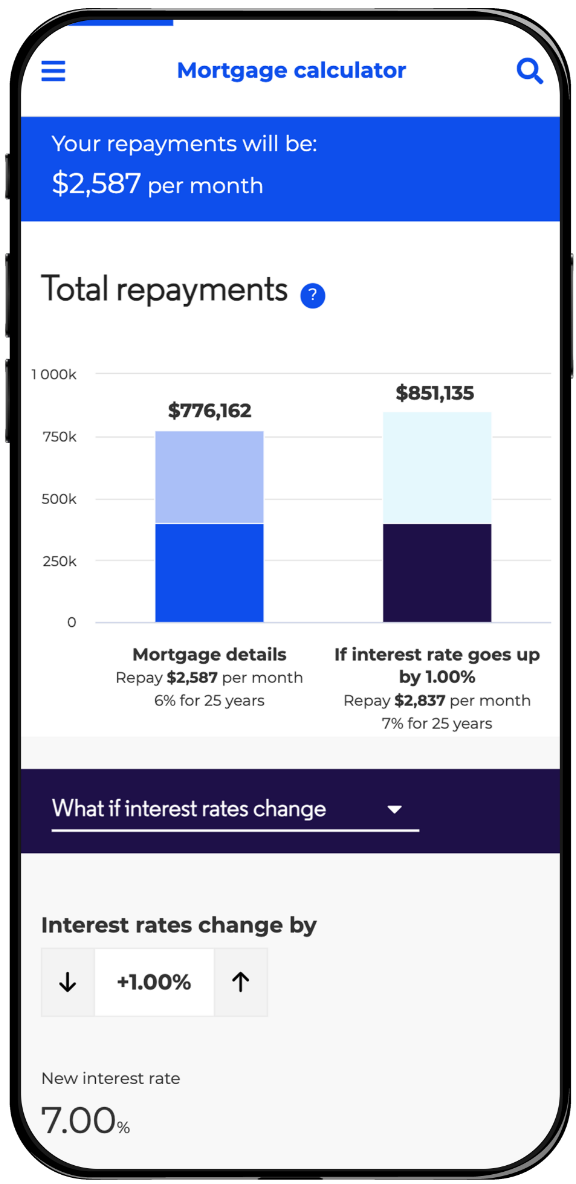

Calculators

Moneysmart's calculators help you set realistic goals and gives you the confidence to take the next step.

Budget planner

Work out where your money is going

Savings goals calculator

Set and reach your goals

Retirement planner

Find out your income when you retire

Income tax calculator

How much Australian income tax should you be paying?

Superannuation calculator

Find out your super balance at retirement

Get help with your money straight to your inbox.

- Sign up to Moneysmart Tips.

- Sign up