Here are some ways to help you get the most out of any retirement savings.

Do a retirement budget

When you retire, some of the things you spend your money on will change. Having a budget will give you a plan – and control - for your retirement spending.

If you’re not sure how to even start thinking about how much you might spend in retirement, you can:

- Check out the Retirement Standard published by the Association of Super Funds of Australia (ASFA).

- Check out the current spending levels of retirees, published by Super Consumers Australia.

- Use a rule of thumb, such as 70% of your current spending level.

You can use the Moneysmart budget planner to work out where your money is likely to be spent in retirement.

How to Make Your Super Last in Retirement

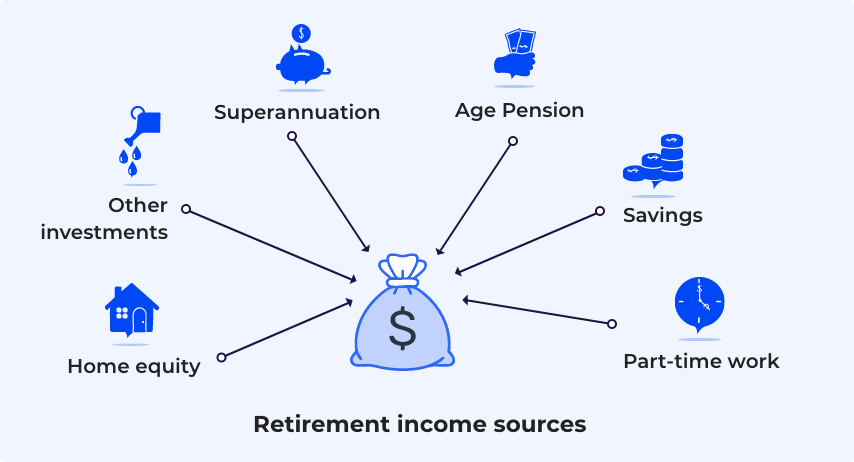

Learn about different sources of retirement income

You might have more sources of income in retirement than you think. For example:

For many Australians, superannuation and/or the Age Pension are their main sources of income in retirement. So, we’ve focused on those two sources below.

It’s important to know that you may also have some of the other options above though. Learn more about sources of retirement income.

Check if you can get government assistance

Around 62% of Australians aged 65 or older get income support payments from the government. Government entitlements can help boost your income and reduce your costs in retirement.

You might be eligible for government benefits such as:

- Age Pension

- Disability Support Pension

- Carer Payment

You might also be able to receive one or more concession cards. They can give you discounts on things like public transport, prescriptions, health care, utility bills and insurance.

- Pensioner Concession Card

- Seniors cards

- Commonwealth Seniors Health Card

Not sure where to start with government assistance? Read the Services Australia Guide to Australian Government payments.

Decide what to do with your super

How and when you choose to access and use your super can make a big difference to how long it lasts.

There are lots of different things you can do with your super when you retire, including:

Leave it in super

You can leave your money in super as long as you like and just apply to take some out when you need it.

Start an account-based pension

This type of account pays you a regular income stream. You can also take out bigger amounts when you want to.

Withdraw your super and put it somewhere else

You can take your money out of the super system and invest it in some other way.

Start an annuity/lifetime income stream

This type of account pays you a regular income for the rest of your life.

Use a Transition to Retirement account

This type of account can be used between the ages of 60 and 65, if you want to start using your super but you're still working.

Do a combination

Choose any combination of the above options!

Learn more about what you can do with your super when you retire.

Ready to plan?

Now that you’ve worked through your spending, your savings, your government assistance opportunities, and choices you can make with your super, it’s time to try the retirement planner.

The Moneysmart retirement planner can help you to:

- Estimate how much income you will have in retirement

- Check if you are on track to achieve your retirement goals

- Create a retirement plan

You can add in career changes and breaks, big lifestyle goals that need extra money on top of your living expenses, plus changes in investment choices and regular income.