Start here

Moneysmart, by the Australian Government, helps you make confident money decisions with free tools, tips and calculators.

Be aware of disaster chasers

If you're affected by a natural disaster, be alert to high-pressure sales tactics.

Protect your money

Is your super performing for you?

Tips on checking your personal details, performance, fees and more.

Your checklist

How to spot a scam website

Simple steps to help you spot a fake.

Stay smart

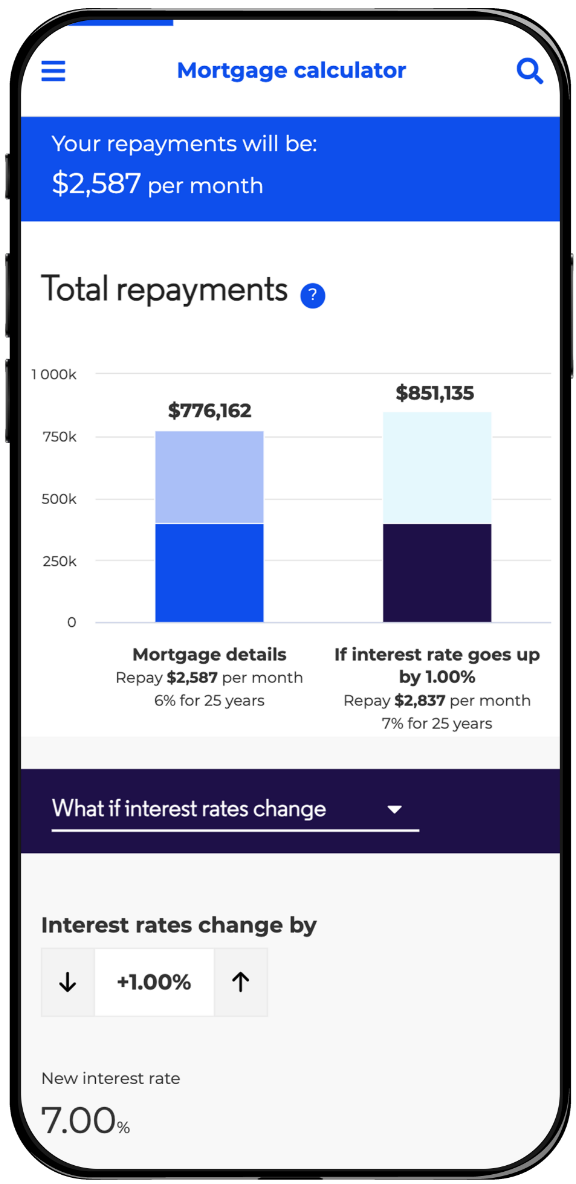

Calculators

Moneysmart's calculators help you set realistic goals and gives you the confidence to take the next step.

Budget planner

Work out where your money is going

Savings goals calculator

Set and reach your goals

Retirement planner

Find out your income when you retire

Income tax calculator

How much Australian income tax should you be paying?

Superannuation calculator

Find out your super balance at retirement

Get help with your money straight to your inbox.

- Sign up to Moneysmart Tips.

- Sign up